Roll Out Rate Definition . Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. Monitoring changes in roll rates. definition of roll rate. For example, will customers who have. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. organizational change management and the rolling out of new processes, structures, or systems allow a. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. Roll rates are used by analysts to predict. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Put simply, a roll rate measures the movement of customers between different credit risk.

from www.slideshare.net

roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. organizational change management and the rolling out of new processes, structures, or systems allow a. Roll rates are used by analysts to predict. For example, will customers who have. Monitoring changes in roll rates. Put simply, a roll rate measures the movement of customers between different credit risk. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. definition of roll rate. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency.

Roll Rate Model Using R in Finance

Roll Out Rate Definition roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. Roll rates are used by analysts to predict. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. organizational change management and the rolling out of new processes, structures, or systems allow a. For example, will customers who have. Put simply, a roll rate measures the movement of customers between different credit risk. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Monitoring changes in roll rates. definition of roll rate.

From www.youtube.com

🔵 Rollout Meaning Roll Out Definition Rollout Examples Business Roll Out Rate Definition the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. Monitoring changes in roll rates. Put simply, a roll rate measures the movement of customers between different credit risk. Roll rates are used by analysts to predict. Roll rates help quantify the. Roll Out Rate Definition.

From www.isixsigma.com

Rolled Throughput Yield (RTY) Definition Roll Out Rate Definition Put simply, a roll rate measures the movement of customers between different credit risk. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Roll rates. Roll Out Rate Definition.

From thirdspacelearning.com

Flow Rate GCSE Maths Steps, Examples & Worksheet Roll Out Rate Definition For example, will customers who have. definition of roll rate. Monitoring changes in roll rates. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. roll rates aid in. Roll Out Rate Definition.

From www.youtube.com

Flow Rate Analysis Roll Rate Analysis Ageing Schedule IFRS 9 Roll Out Rate Definition roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. roll rates aid in early identification of delinquency, enabling. Roll Out Rate Definition.

From www.youtube.com

Roll rate Meaning YouTube Roll Out Rate Definition roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Put simply, a roll rate measures the movement of customers between different credit risk. For example, will customers who have. organizational change management and the rolling out of new processes, structures, or systems allow a. roll rate is the proportion of customers. Roll Out Rate Definition.

From discuss.cubepilot.org

FILT values for Rate Roll, Rate Pitch and Rate Yaw deactivated Roll Out Rate Definition roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Monitoring changes in roll rates. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. the roll rates are simply based on the percentage of balances (or debts) that migrate or. Roll Out Rate Definition.

From www.slideserve.com

PPT Introduction to Rates PowerPoint Presentation, free download ID Roll Out Rate Definition Monitoring changes in roll rates. Roll rates are used by analysts to predict. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Put simply, a roll rate measures the movement of customers between different credit risk. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with. Roll Out Rate Definition.

From www.smlease.com

What is the difference between Roll Pitch Yaw Aircraft Motions Roll Out Rate Definition For example, will customers who have. Monitoring changes in roll rates. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Put simply, a roll rate measures the movement of customers between different credit risk. Roll rates are used by analysts to predict. organizational change management and the rolling out of new processes,. Roll Out Rate Definition.

From printablelibboggart.z19.web.core.windows.net

Unit Rate Definition 6th Grade Roll Out Rate Definition Put simply, a roll rate measures the movement of customers between different credit risk. Monitoring changes in roll rates. organizational change management and the rolling out of new processes, structures, or systems allow a. definition of roll rate. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. For example, will. Roll Out Rate Definition.

From w3prodigy.com

How to Calculate Employee Turnover Rate in 3 Steps HR University (2024) Roll Out Rate Definition Put simply, a roll rate measures the movement of customers between different credit risk. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. For example, will customers who have. Roll rates help quantify the delinquency and default behaviour of credit portfolios. Roll Out Rate Definition.

From www.researchgate.net

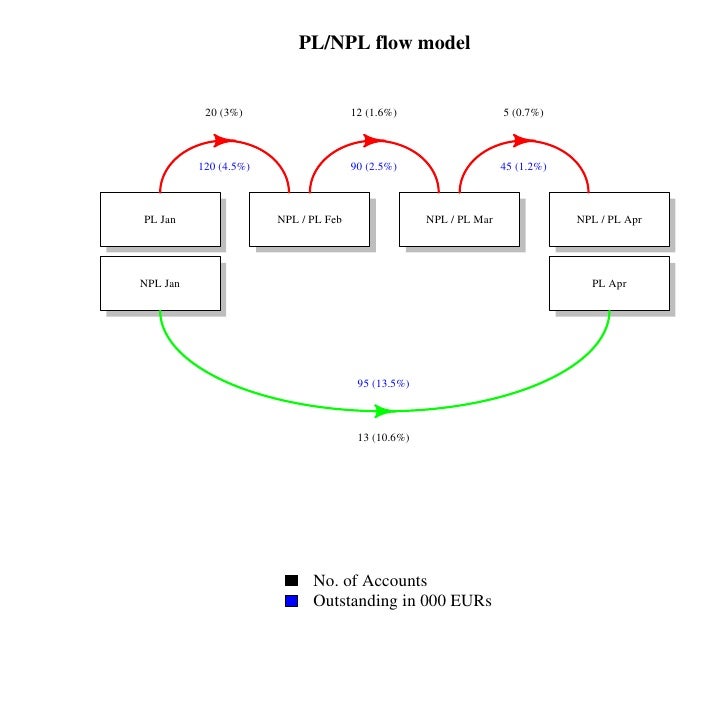

A diagram showing the definitions of the net roll rates through the Roll Out Rate Definition definition of roll rate. Monitoring changes in roll rates. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. roll rate is the. Roll Out Rate Definition.

From www.researchgate.net

Smart meter roll‐out rates in EU member states and Norway in 2021 Roll Out Rate Definition For example, will customers who have. Put simply, a roll rate measures the movement of customers between different credit risk. definition of roll rate. Monitoring changes in roll rates. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large. Roll Out Rate Definition.

From www.youtube.com

Rates and Unit Rates YouTube Roll Out Rate Definition Put simply, a roll rate measures the movement of customers between different credit risk. organizational change management and the rolling out of new processes, structures, or systems allow a. the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. roll. Roll Out Rate Definition.

From www.researchgate.net

Maximum roll rates in the simple and horizontal curves for various Roll Out Rate Definition the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. Roll rates help quantify the delinquency and default behaviour of. Roll Out Rate Definition.

From www.chegg.com

Roll Rate, Weight Transfer and Actual Turning Center Roll Out Rate Definition the roll rates are simply based on the percentage of balances (or debts) that migrate or rotate from a given delinquency cycle in period «t» to another. Put simply, a roll rate measures the movement of customers between different credit risk. Monitoring changes in roll rates. roll rate is the proportion of customers who will be 'better', 'worse'. Roll Out Rate Definition.

From www.slideshare.net

Roll Rate Model Using R in Finance Roll Out Rate Definition Monitoring changes in roll rates. For example, will customers who have. organizational change management and the rolling out of new processes, structures, or systems allow a. Roll rates help quantify the delinquency and default behaviour of credit portfolios with large number of borrowers. roll rates aid in early identification of delinquency, enabling timely interventions to minimize potential losses.. Roll Out Rate Definition.

From airfocus.com

What is Retention Rate? Definition and FAQ airfocus Roll Out Rate Definition Put simply, a roll rate measures the movement of customers between different credit risk. For example, will customers who have. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. Roll rates are used by analysts to predict. roll rates aid in early identification of delinquency, enabling. Roll Out Rate Definition.

From learningveronhavi3u.z21.web.core.windows.net

Ratios And Proportions Explained Roll Out Rate Definition definition of roll rate. Roll rates are used by analysts to predict. roll rate is the proportion of customers who will be 'better', 'worse' or 'remain same' with time in terms of delinquency. Monitoring changes in roll rates. organizational change management and the rolling out of new processes, structures, or systems allow a. Put simply, a roll. Roll Out Rate Definition.